Georgia Tax Relief 2025. Atlanta (ap) — georgia lawmakers gave final approval thursday to a package of legislation they hope will limit property tax increases, in what could be republicans'. Updated 1:06 pm pdt, april 18, 2025.

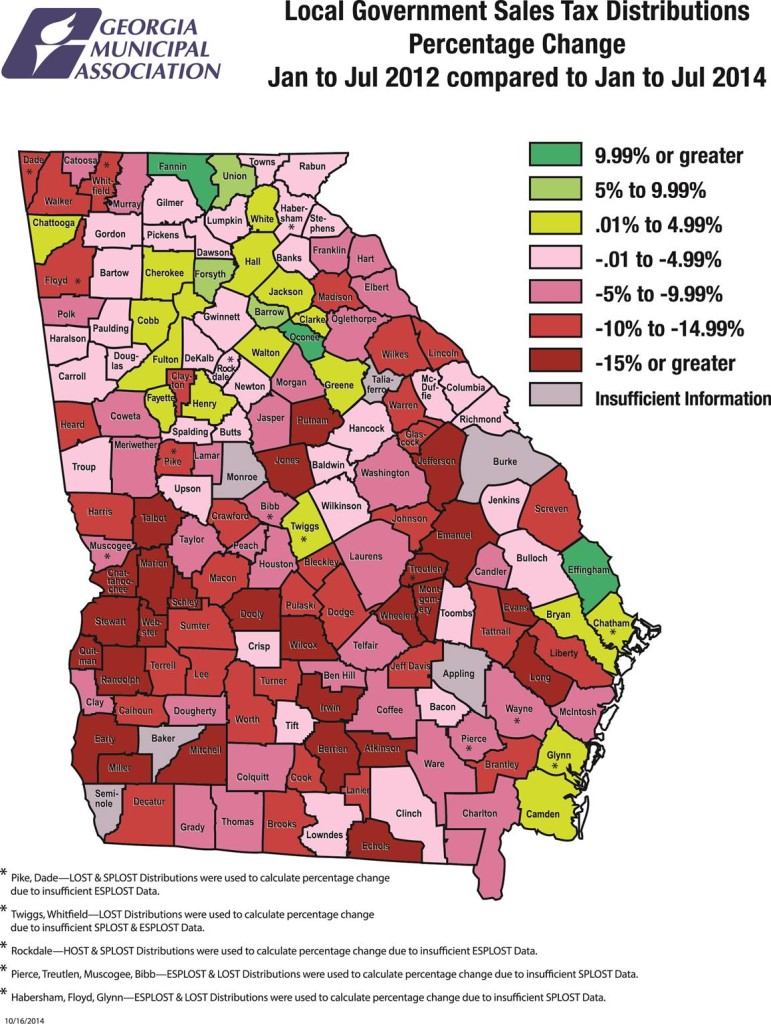

Local rates are weighted by population to compute an average local tax rate. State & local sales tax rates as of july 1, 2025.

Now, kemp is calling on the general assembly to speed up the tax cut by moving the 5.39% state income tax rate due to take effect in 2025 to 2025.

What project 2025 could mean for your wallet in a trump presidency the plan proposes an overhaul of the federal government and.

Columbus, GA Tax Relief Lawyers (888) 972−7231 Center for, The two most significant amendments. This legislation will amend hb 1437, which provides for a step down of 10 basis points in the income tax rate, starting in 2025 and for each taxable year thereafter until the rate.

Homeowner Tax Relief Grant YouTube, Georgia’s senate finance committee plans a hearing on monday on a bill limiting increases in a home’s value, as assessed for property tax purposes, to 3% per year. Updated 1:06 pm pdt, april 18, 2025.

Tax Relief Services Tax Response Center, Updated december 30, 2025 12:09 pm. Updated 1:06 pm pdt, april 18, 2025.

Taxpayers Impacted By Idalia Qualify For Tax Relief Tax, The income tax cuts are retroactive. City, county and municipal rates vary.

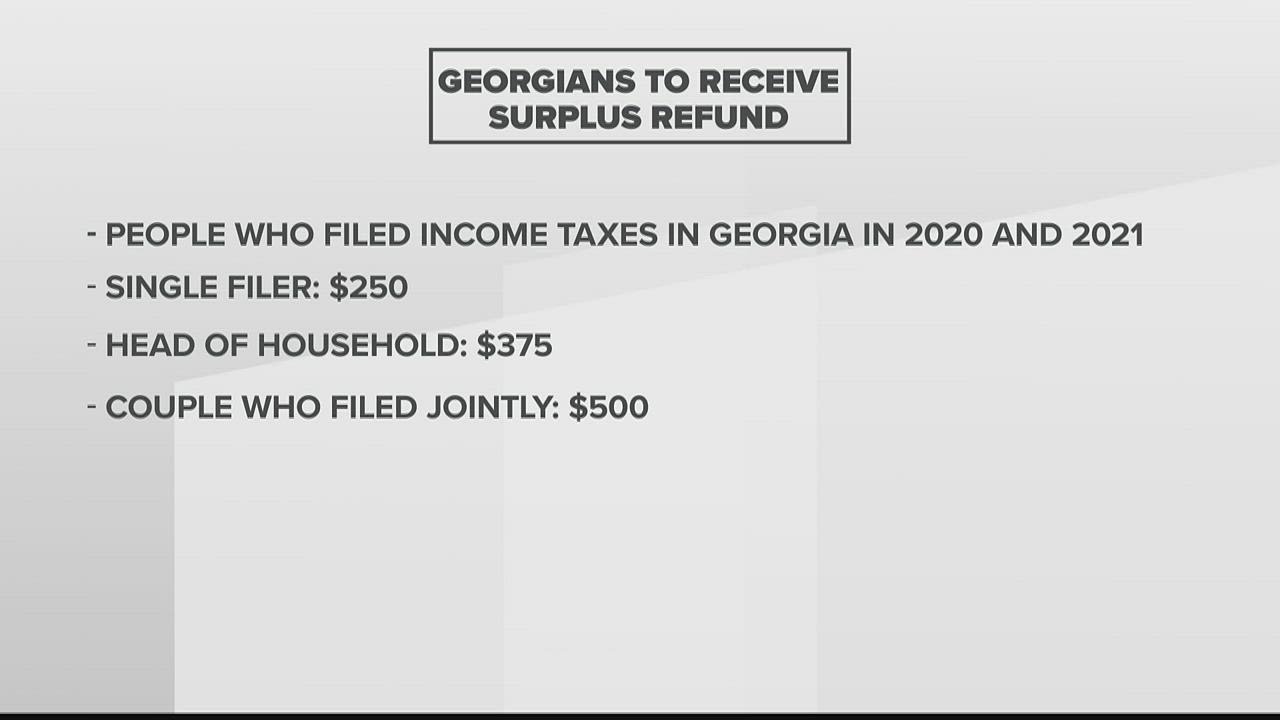

Update on when surplus tax refunds will start arriving YouTube, The senate finance committee on monday approved a rewritten bill and state constitutional amendment that would limit increases in a home’s value, as assessed for property tax. Generally, a homeowner is entitled to a homestead exemption on their home and land underneath provided the home was owned by the.

Will You need To File An Annual Tax Return In ExpatHub.ge, On april 18, georgia governor brian kemp (r) signed several bills into law that will make the state’s tax code more structurally sound. The senate finance committee on monday approved a rewritten bill and state constitutional amendment that would limit increases in a home’s value, as assessed for property tax.

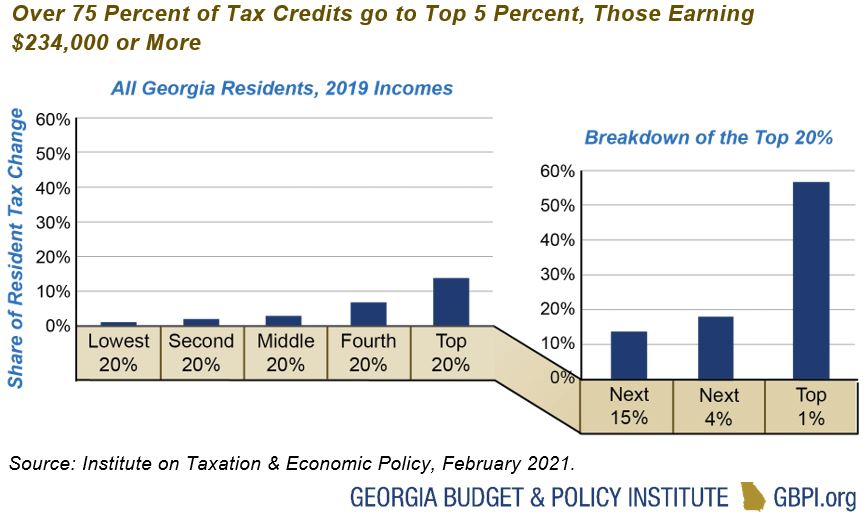

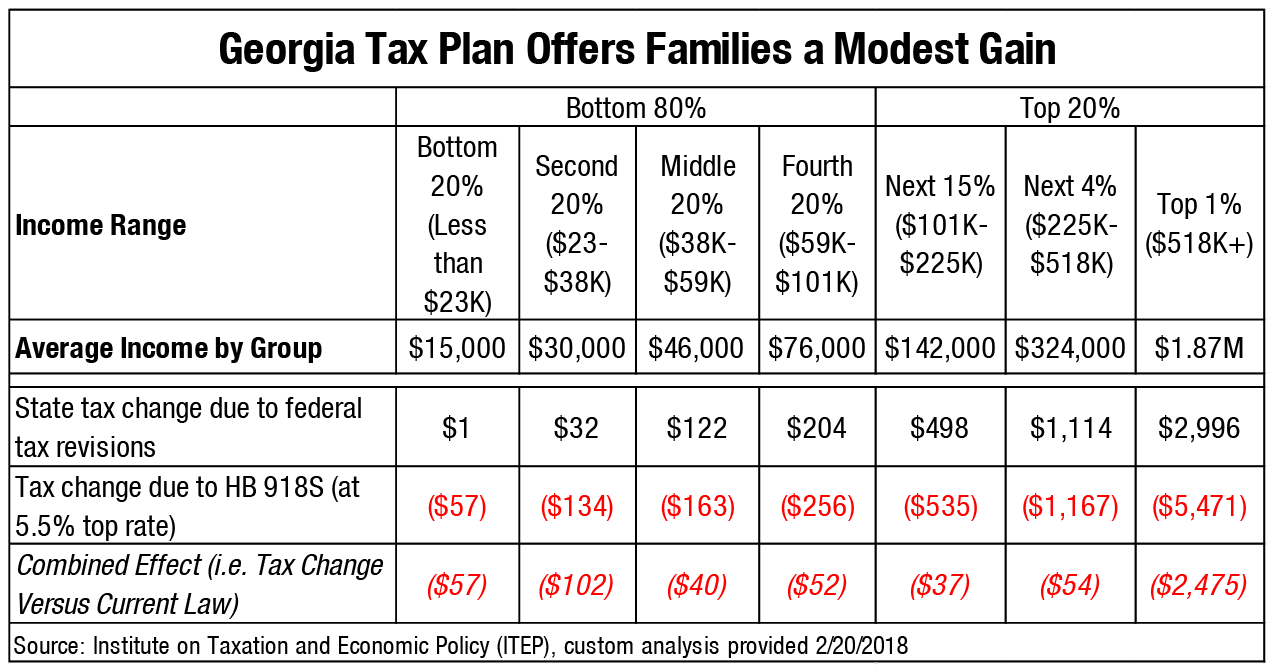

Tax Breaks Don’t Deliver Budget and Policy Institute, Atlanta — georgia lawmakers gave final approval thursday to a package of legislation they hope will limit property tax increases, in what could be republicans' signature tax. Generally, a homeowner is entitled to a homestead exemption on their home and land underneath provided the home was owned by the.

Lawmakers Might Come to Regret Risky Tax Plan, The income tax cuts are retroactive. The two most significant amendments.

Unaccountable Agriculture Tax Break Hurting Rural, Generally, a homeowner is entitled to a homestead exemption on their home and land underneath provided the home was owned by the. Georgians now have a tax package containing income tax cuts, childcare relief, and potential property tax caps.

CALCULATION OF TAX LIABILITY Download Table, Atlanta (ap) — georgia lawmakers gave final approval thursday to a package of legislation they hope will limit property tax increases, in what could be republicans'. Generally, a homeowner is entitled to a homestead exemption on their home and land underneath provided the home was owned by the.

Georgia’s tax collections ran more than $2 billion ahead of projections for the budget year that ended june 30, even though tax revenues fell slightly.